December 2017

What do exports of milk products to the Seychelles, Japanese machinery to Australia, and flowers to Kenya have in common? They were supported by trade finance completed on the blockchain. flow’s Clarissa Dann explains their significance for trade and the outlook for 2018

*photography courtesy of AP Moller Maersk

When will the blockchain come of age in trade finance? The topic appears with relentless regularity on most trade-related conference programmes, and while there have been many proofs of concept and pilots, how close is the industry to seeing some action?

Digitisation has been difficult as cross-border trade involves a large number of variables when communicating information such as country of origin or product details, and transactions generate high volumes of documentation – making some deals uneconomical. It is for this reason that distributed ledger technologies (DLT) – such as blockchain that uses a consensus formation among participants to enable transactions to take place in the absence of a trusted central authority – are seen as a possible solution.

Corporates are keen to experiment with this technology to simplify the process of trade finance across borders and the handful of deals that have been done have one thing in common – the corporates themselves are driving change. This article reviews two trade finance transactions on the blockchain that have actually moved beyond the drawing board (Ornua’s letter of credit (LC) and Marubeni’s LC in the trade chain) and a third pilot that has significant implications for the entire container shipping industry (Maersk and IBM).

Blockchain and the letter of credit (LC) – Ornua case study

At EuroFinance 2017 in Barcelona, Simon Taylor, former Vice President for Entrepreneurial Partnershps at Barclays who went on to co-found fintech consultancy 11:FS told delegates how the bank had provided a blockchain solution to Ornua (formerly the Irish Dairy Board) in the form of a letter of credit transaction.

Announced by Ornua on 6 September 2016, the LC deal between Ornua and Seychelles Trading Company was handled on a platform developed by Israeli start-up fintech Wave, one of 11 start-ups that had gone through the Barclays Accelerator programme in 2015. At the time, Group Trade Finance Manager David O’Rourke said, “Moving to paperless trade would be hugely beneficial in supporting the supply chain, through reduced costs, error-free documentation, and fast transfer of original documents to our customers worldwide.”

In his article, How blockchain can restore trust in trade, published on 1 February 2017, Jesse McWaters, Project Lead for Disruptive Innovation in Financial Services at the World Economic Forum, observed, “The transaction guaranteed the trade of almost US$100,000 worth of cheese and butter between Irish agricultural food co-operative Ornua and the Seychelles Trading Company. The process – from issuing to approval of the letter of credit, which usually takes between seven and 10 days – could be reduced to less than four hours.”

Blockchain LC in the trade chain – Marubeni Corporation

On 6 July 2017, Japanese conglomerate Marubeni Corporation and Sompo Japan Nipponkoa were involved in a trade transaction between Australia and Japan using blockchain/distributed ledger technology (DLT).

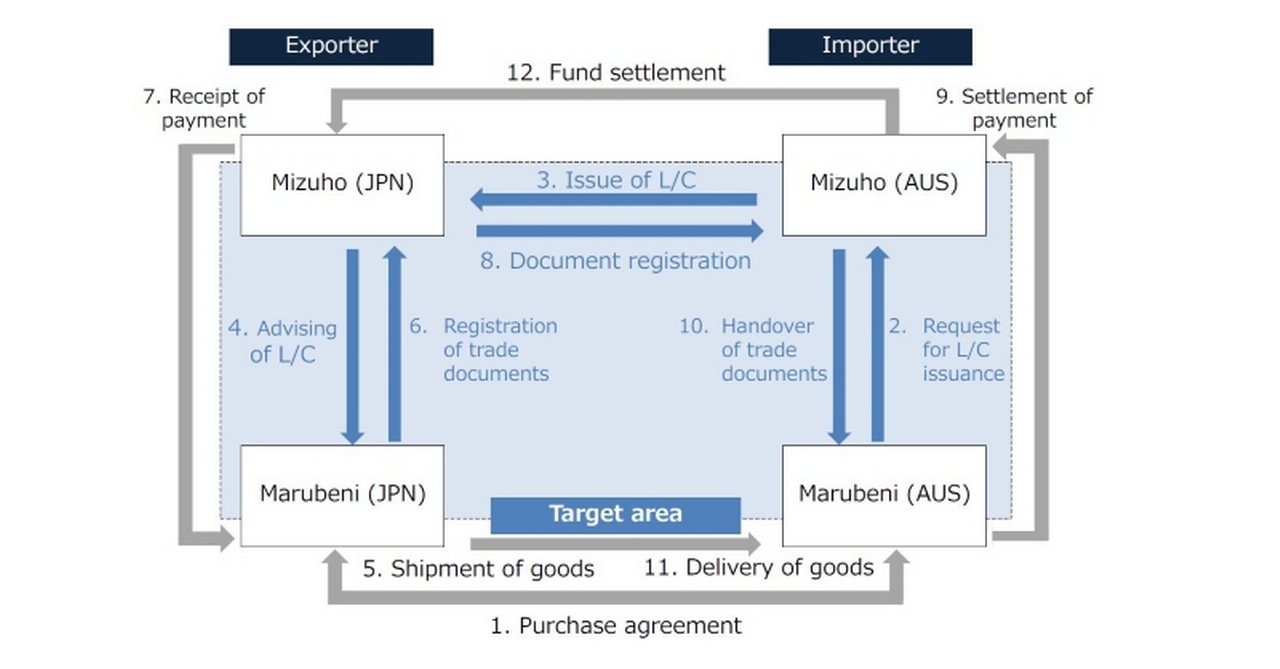

Figure 1: summary of deal

Source: Marubeni CorporationThis particular trade transaction between Australia and Japan saw all the trade-related processes, from issuing a letter of credit to delivering trade documents completed entirely via IBM’s Hyperledger Fabric platform using blockchain DLT. This resulted in the following benefits once the transaction was complete:

- Shorter delivery time for trade documents, reducing from multiple days to two hours;

- Reduction of time required to crate and transmit documents, as well as labour and other costs through document digitalisation; and

- Increased transparency by sharing transaction details with all parties.

However, there were also a number of drawbacks pointed out:

- It is not possible to transmit trade transaction information in digital blockchain/DLT format to parties who do not use the platform – the whole lot has to be done as before if even just one party cannot use it.

- Standardisation of trade information for blockchain/DLT at an international level is the way forward - something Daniel Schmand has stated in his capacity of ICC Banking Commission Chair when he said that standardisation of data and file formats, data exchange and security protocols remained a challenge, along with integration with old legacy systems.

Blockchain and the supply chain - Maersk and IBM

Maersk, the Danish container shipping giant has been testing a blockchain solution from the University of Copenhagen to digitise the ships’ cargo inventories. It ran a Proof of Concept (PoC) with IBM in September 2016 tracking a container of flowers from the Kenyan port Mombasa to Rotterdam in the Netherlands. As with the Marubeni deal the technology for this pilot is based on the Linux Foundation’s open source Hyperledger Fabric, designed to support multiple parties across the ocean shipping ecosystem. It is hosted on the IBM Cloud and its high security business network.

On 5 March 2017 IBM and Maersk announced their collaboration “to use blockchain technology to help transform the global, cross-border supply chain”. Of the US$20trn of global trade that flows each year, 90% of it is carried by the ocean shipping industry. “IBM and Maersk intend to work with a network of shippers, freight forwarders, ocean carriers, ports and customs authorities to build the new global trade digitisation solution,” stated IBM. It adds that the digitised process helps “reduce fraud and errors”, “reduces time products spend in the transit and shipping process, improves inventory management and ultimately reduces waste and cost”. Tellingly it notes, “Maersk found in 2014 that a simple shipment of refrigerated goods from East Africa to Europe can go through nearly 30 people and organisations, including more than 200 different interactions and communications among them.”

In the “Streamlining global trade video” (published November 2017) that has attracted nearly 2000 views already IBM and Maersk demonstrate the problem and the solution in just over three minutes (see Figure 1)

Figure 2: IBM/Maersk video

IBM has highlighted that the costs associated with trade documentation processing and administration are estimated to be up to one-fifth of the actual physical transportation costs. “A single vessel can carry thousands of shipments, and on top of the costs to move the paperwork, the documentation to support it can be delayed, lost or misplaced, leading to further complications. It then sets out how the blockchain-based approach would work.

- As an immutable, secure, rich and transparent shared network the blockchain provides each participant with end-to-end visibility based on their level of permission.

- Each participant in a supply chain ecosystem and view the progress of goods through the supply chain understanding where a container is in transit. They can also see the status of customs documents or view bills of lading and other data. Customs authorities benefit, says IBM, from improved information available for risk analysis and targeting “which may eventually lead to increased safety and security as well as greater efficiency in border inspection clearance processes

- Detailed visibility of the container’s progress through the supply chain is enhanced with the real time exchange of original supply chain events and documents

- No one party can modify, delete or append any record without consensus from others on the network.

Deutsche Bank and DLT

Deutsche Bank has been investigating DLT, blockchain and transaction digitalisation technologies since 2014.

Figure 3: The blockchain ecosystem Deutsche Bank’s role in it

The infographic, Banking in the Future, the potential impact of Blockchain technology, explains how the growing array of DLT technologies can be used for a variety of use cases, but as fintech solutions proliferate, there will be a need for a “gateway” and trusted adviser between the old and new worlds, particularly in the financial services sector (see Figure 2). Such a “facilitator” would interface with both worlds. Examples of this are advising on interfacing and accessing information assets such as accounts, finding and verifying real world events (confirming whether agreed parameters actually occur such as FX rates) and entering and recording transactions into the relevant blockchain.

The second infographic, Potential impact of Blockchain on key industries, makes the point that the most immediate impact of blockchain “won’t be seen in the financial services industry” (which correlates with Simon Taylor’s prediction), but in “other industries that are less regulated”. These include “energy, supply chain management and the insurance sector where Blockchain technology can provide – among other things – trust, transparency and automation.

Clarissa Dann is Cash and Trade Editorial Director at Deutsche Bank GTB Marketing

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, MACRO AND MARKETS

Syntagma Square synergies in trade Syntagma Square synergies in trade

With more than 300 delegates from more than 145 nations gathered in Greece at the EBRD’s Trade Facilitation Programme Trade Finance (TFP) Forum 2019, it was clear that 20 years after the TFP’s foundation, countries lacking in correspondent banking lines need this trade leg-up more than ever. Clarissa Dann reports from Athens

CORPORATES BANK SOLUTIONS

A Guide to Digital Trade Finance A Guide to Digital Trade Finance

Digitalisation has long been a priority for the trade finance industry, with operational efficiency and lower transaction costs among the anticipated benefits. Where has the journey got to? And how have common frameworks evolved? With contributions from experts across the trade finance industry, this Guide to Digital Trade Finance charts the direction of travel

A Guide to Digital Trade Finance MoreTrade finance and lending

Trade re-set? Trade re-set?

Independent economist Rebecca Harding shares three reasons why she believes trade will never be quite the same again